net operating working capital investopedia

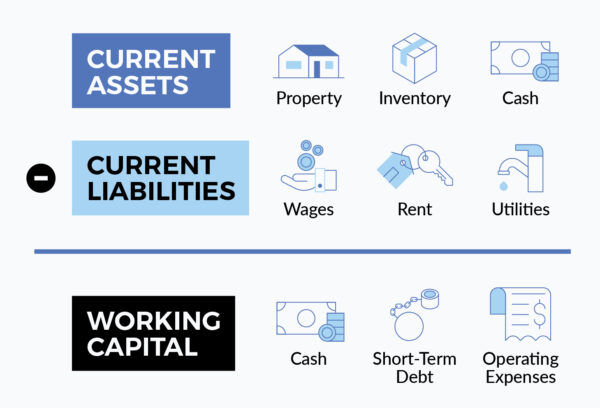

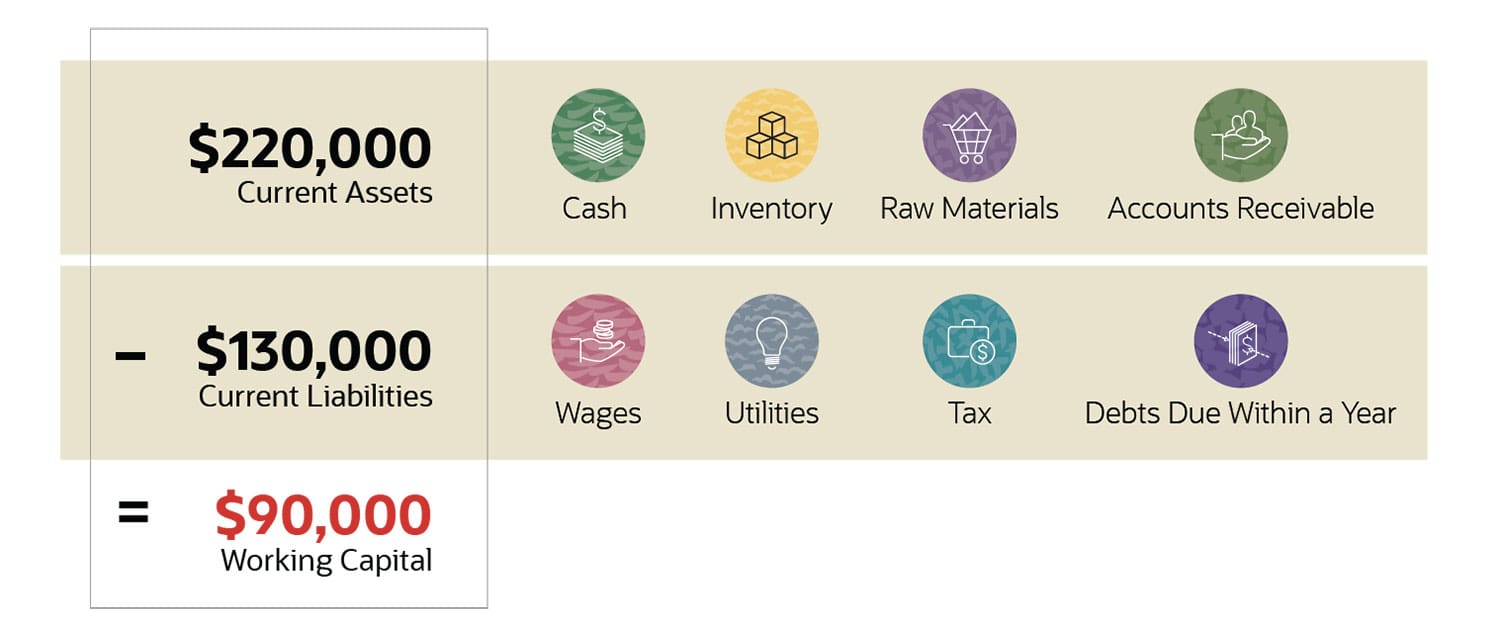

It is used to measure the liquidity. Operating Working Capital OWC Current Assets Accounts Receivable Inventory Value Current Liabilities Accounts Payable The current.

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

This metric is much more tied to cash flows than the net working.

. Working capital also called net working capital is the amount of money a company has available to pay its short-term expenses. Companies that have a large amount. Operating cash flow is a measure of the amount of cash generated by a companys normal business operations.

Net operating working capital is a direct measure of a companys liquidity operational efficiency and its overall financial health at least in the short-term. Calculate total net operating capital for Best Buy Inc. Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales.

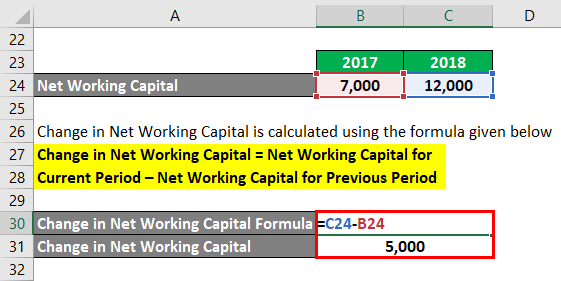

A working capital adjustment occurs when a seller does not deliver the net working capital pegged by the buyer as part of the tangible asset backing required to close a transaction. Net operating working capital NOWC is the excess of operating current assets over operating current liabilities. To calculate total operating.

You can calculate net operating working capital by adding total Cash accounts receivable and inventories minus accounts payable and accrued expenses. Net Operating Working Capital Operating Current Assets Operating Current Liabilities. Operating Cash Flow - OCF.

Net operating working capital NOWC is a financial metric that measures a companys operating liquidity by comparing operating assets to operating liabilities. The net operating working capital formula is calculated by subtracting working liabilities from working assets like this. In essence the NOWC is part of the TOC.

Say that Company A has 12 million in net sales over the. To calculate it use the following. Current assets include cash.

Here is the requisite calculation formula. More Current Ratio Explained. What is the difference between net operating working capital and the total operating capital.

Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities. Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. Operating cash flow indicates.

/TermDefinitions_CFF_finalv1-f2cdc1f2ec574548a8ccf94dd8cb7cfc.png)

Cash Flow From Financing Activities Cff Formula Calculations

Working Capital What Is It And Why Do You Need It Business 2 Community

Change In Net Working Capital Formula Calculator Excel Template

Operating Cycle Definition Example How To Interpret

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

Cash Flow Statements Reviewing Cash Flow From Operations

/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

Ebit Vs Operating Income What S The Difference

What Is Working Capital How To Calculate And Why It S Important Netsuite

/CapitalStructureV3-f35fe15141e6459989ddc22ecd181162.png)

Capital Structure Definition Types Importance And Examples

Change In Net Working Capital Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/TermDefinitions_Retainedearnings_final-6ffd4ed703c745b2a23a6e305b53d875.png)

Retained Earnings In Accounting And What They Can Tell You

/Capital-final-e177751d17a642d8860382a56d51e3bc.png)

Capital Definition How It S Used Structure And Types In Business

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Working Capital Definition Formula Examples With Calculations

/capitalexpenditure_final-4a78dede006c43dcbf2fc2114696199d.png)

Capital Expenditure Capex Definition Formula And Examples

Operating Cash Flow Definition Formula And Examples

Operating Working Capital Owc Formula And Calculator

/days-payable-outstanding-4197475-01-FINAL-9982e5c8025840c2913e1c13e4c6d6aa.png)

Days Payable Outstanding Dpo Defined And How It S Calculated

/PPE-302f48c4b0974ab78d2ced2edee34538.png)

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)